Disruption.

That is the theme for many distributors throughout COVID-19.

According to a recent report by McKinsey & Company, “[W]e believe that history provides valuable lessons. For many distributors, the responses that worked in previous recessions are now table stakes. In our analysis of the approximately 100 publicly traded distributors, we looked at their performance and actions through the previous recession. We found that some companies increased revenues and margins faster than peers did and provided shareholders with nearly double the returns of average competitors.”

How does McKinsey attribute this success?

- Developed nimble cost structure

- Managed cash more carefully and built war chests

- Pursued programmatic M&A through downturns

Of course, the COVID-19 pandemic is different from the Great Recession because of the quick movement that caused this downturn.

However, we agree with McKinsey. Those who manage costs, build war chests and capitalize on opportunities will be more successful than ever before.

In Cascade’s most recent report, we noted, “The industrials sector has always experienced cyclicality with booms and busts. But the COVID-19 crisis combined with new technologies and a global economy are causing a sea change never seen before by manufacturers and distributors. The pace of change has accelerated and critical decisions must be made in the months to come. M&A activity bears witness to the challenges and opportunities in the sector as deals are being consummated regularly.”

Kiplinger forecasts GDP growth of 2.0% for Q4 2020 and 5.3% for the year of 2021. The manufacturing recovery is also expected to continue with Kiplinger estimating that 43% of manufacturers will add capacity with the medical device sector expected to be a significant contributor. Also, assembly plants are projected to spend $4.7 billion on new equipment including robots and 3D printers (37% of plants expected to invest in 3D printers, a record high).* The terms “value-added manufacturer” and “value-added distributor” continue to expand upon the definitions, where participants within all levels of the supply-chain are expected to add value in different ways, from additive manufacturing to providing real-time data.

*The Kiplinger Letter, January 8, 2021, Volume 98, No. 1

Acquisitions within the sector continued at a torrid pace in the fourth quarter with 34 deals in December alone, per Eric Smith of MDM. Heavy activity within the building material distribution led the way with three acquisitions by US LBM Holdings, two deals by Hardwoods Distribution, Inc. and one by U.S. Lumber. In addition, The Home Depot closed its acquisition of HD Supply Holdings ($8 billion) and Specialty Building Products sold a majority stake to The Jordan Company. Other active product distribution and service sub-sectors include facilities maintenance (janitorial, HVACR), food service, safety products and landscaping.

Private equity distribution activity also remained steady with several PE-backed companies consummating acquisitions, including Motion & Control Enterprises (Frontenac), Distribution International (Advent), Merit Distribution Group (Center Rock) and Individual FoodService (Kelso). As we discuss in our report, distributors that are either unable or not interested in investing in the new technologies and processes required by today’s manufacturer should strongly consider selling while buyers continue to aggressively pursue industry consolidation.

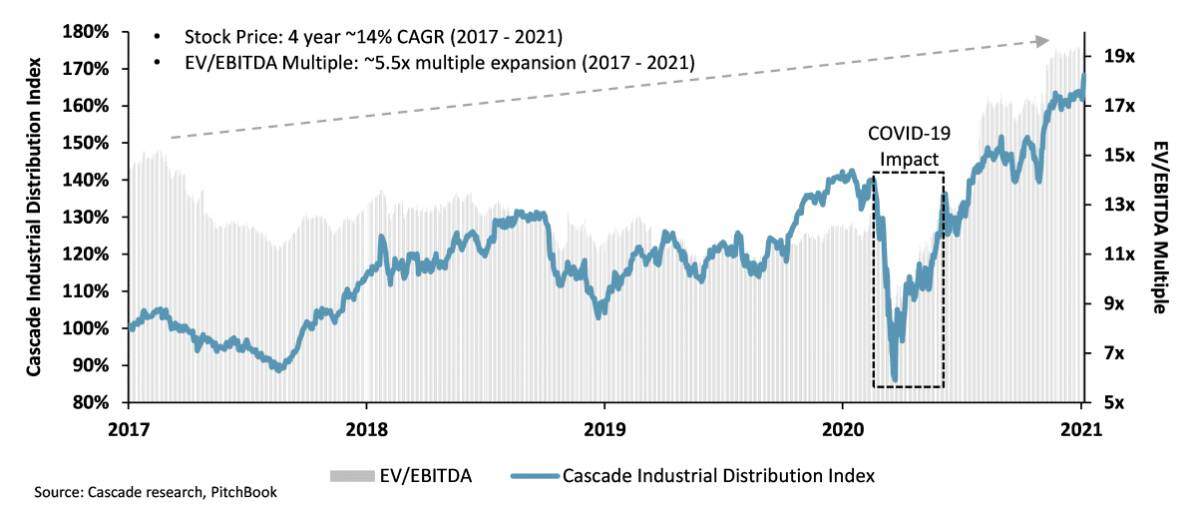

M&A appetite is forecast to remain robust, as strategic acquirers are focused on a balanced capital allocation strategy that includes programmatic M&A, and private equity investors (both with and without portfolio companies in this space) continue to seek quality opportunities to deploy record amounts of dry-powder available. Additionally, both strategic and private equity buyers across the spectrum are canvasing the middle-market and lower middle-market for quality acquisition targets, as opportunities within larger segments are continually becoming fragmented. This has led to a “seller’s market” with significant competition and premium valuations. Cascade’s Industrial Distribution Index, which includes the sector’s most active public acquirers, experienced a four-year stock price appreciation at an approximately 14% CAGR and approximately 5.5x (EV/EBITDA) multiple expansion over the same period. This data does not include private sector performance or the record valuation levels from private company exits and acquisitions over the past 18 months. While trading multiple and share appreciation can be attributed to a strong stock market, a capital allocation approach inclusive of programmatic M&A is also likely a contributor to improved performance.

Now is the time to manage costs, but also to capitalize on opportunities. Cascade Partners is actively working with buyers and sellers looking to capitalize on current economic conditions and the forecast for a strong 2021. If you are considering strategic options and want to learn more about the current M&A market, please contact us for a confidential conversation.